Are you stuck on the content hamster wheel?

It feels awful. You’re writing, you’re publishing, doing everything you’re supposed to, but that traffic needle? It just won’t budge. Meanwhile, you see your competitors snagging rankings for all sorts of juicy terms. You’re left scratching your head: “What do they know that I don’t?”

Here’s the secret: It’s probably not a secret formula. It’s a strategy. They aren’t just guessing what to write. They’re strategically finding and targeting the gaps in your content armor.

This is where the magic happens. We’re about to talk about the single most powerful strategy I’ve ever used to bust through traffic plateaus and find hidden gold. We are going to cover, from top to bottom, how to do a keyword gap analysis.

This isn’t just another boring SEO chore. Think of it as a treasure map. It shows you exactly where your competitors are striking gold and, more importantly, where they’ve left some behind for you.

Forget throwing content at the wall and hoping it sticks.

It’s time to get surgical.

More in Keyword Research Category

How To Measure Keyword Difficulty

Find Low-Competition High-Traffic Keywords

Key Takeaways

Before we dive deep, here’s the 30,000-foot view of what you’re about to learn:

- What It Is: A keyword gap analysis is simply the process of finding valuable keywords that your competitors rank for, but you don’t. Simple as that.

- Why It’s Critical: This moves you away from a guessing game. You stop guessing and start using a data-driven content strategy, finding proven topics you know your audience wants.

- The Core Process: The method is straightforward: pinpoint your true competitors, use a good SEO tool to compare your site’s keywords against theirs, and then filter those results to find the high-value, low-difficulty gems.

- It’s Not Just Keywords: An analysis like this also shines a light on topic gaps, search intent mismatches, and even strategic weaknesses in your competitors’ content that you can exploit.

- Action is Everything: This data is worthless without a plan. The final step is always to prioritize these new keywords and build them right into your content calendar.

What Exactly Is a Keyword Gap Analysis, Anyway?

In the simplest terms? It’s a side-by-side comparison.

Imagine you and your top three competitors are fishing in the same lake. You’ve all got your own “secret” fishing spots—your keywords—where you catch fish, or traffic.

A keyword gap analysis is like sending up a drone. It scans the entire lake and pinpoints every single spot where your competitors are catching fish, but you don’t even have a line in the water.

It’s the process of finding the search terms that are sending traffic to other sites in your niche… but are completely missing from your website. You’re hunting for the “gaps” in your keyword net. These gaps represent massive, untapped potential. They’re your next big articles, your next landing pages, your next product features. They are things you know people are already looking for.

So, why should I even bother with this?

I get it. You’re busy. You already have a content idea list a mile long. Why add another complicated “SEO task” to your plate?

Because this isn’t just another task. It’s a fundamental shift in how you build your strategy.

Most content marketing is proactive, which is really just a fancy word for “educated guessing.” You brainstorm, you look at trends, and you write what you think your audience wants. A keyword gap analysis, though? It’s reactive in the best possible way. It’s not based on a hunch. It’s based on cold, hard, proven data.

You’re letting your competitors spend their time and money testing the waters. They’ve done the hard part of figuring out what topics resonate and, more importantly, what topics convert. You’re just waltzing in, looking at their successful playbook, and finding the plays they aren’t running perfectly—or at all.

It is the single fastest way to find a list of high-intent keywords that you know have commercial value.

Is this just about “stealing” competitor keywords?

That’s one way to look at it, but it’s a little shortsighted. It’s not just about “stealing.”

It’s about understanding the entire conversation your audience is having.

Think about it. If all your competitors are ranking for “best lightweight hiking boots” and you’re not, it doesn’t just mean you’re missing a keyword. It means you are completely absent from a critical part of the buyer’s journey. You’re not even in the running when your potential customer is pulling out their credit card.

This analysis helps you:

- Find new content topics you never, ever would have thought of on your own.

- Understand your competitors’ focus. Are they targeting beginners? Experts? People on a budget? Their keywords will tell you.

- Discover new product or service ideas based on the “problem-aware” keywords people are searching for.

- Identify “quick win” keywords where your competitors are ranking, but they’re doing a bad job with weak, thin, or outdated content.

It’s less about theft and more about comprehensive market intelligence. You’re just filling in the blanks that your competitors were nice enough to expose for you.

The “Aha!” Moment: Why This Isn’t Just Busy Work

I’ll be honest. For the first few years of my marketing career, I ignored this entire process. It sounded too technical, too “in the weeds.” I was a writer, dammit. I preferred to focus on brainstorming creative topics and crafting great articles.

My traffic was flat. Frustratingly, stubbornly flat.

One of my main competitors, a site that was much newer than mine, was just zipping past me in the search results. I was bitter. I was convinced they were doing something shady, using some black-hat trick.

Finally, totally fed up, I signed up for a free trial of an SEO tool (I think it was Semrush back then). I ran my first real keyword gap analysis. I plugged in my site and that one competitor I secretly hated.

The results flooded in. Thousands of keywords. I was instantly overwhelmed.

But then I started to filter. I filtered for keywords they ranked for in the top 10, but I didn’t rank for at all. Then, I filtered by a “Keyword Difficulty” score of under 30.

The list shrank from thousands to about 40.

And right there, sitting at number three, was a keyword I had never once considered. It was a long-tail, super-specific question related to my industry. It had decent search volume, and my competitor was ranking #4 with a pathetic, 300-word blog post.

That was my “aha!” moment.

I spent the next two days writing the most comprehensive, helpful, 2,500-word guide on that exact topic. I mean, I emptied the tank on that article. I published it.

Within three weeks, I was ranking #2, one spot above my competitor. That single article, born from a 10-minute analysis, became one of my top 5 traffic-driving posts for over a year.

It wasn’t magic. It was just data. This stuff works.

What kind of “treasure” can you really find?

That one example was just the tip of the iceberg. When you do this right, you’re not just finding a random list of keywords. You’re finding specific, actionable opportunities.

Here’s the kind of “treasure” a good gap analysis will uncover:

- “Quick Win” Keywords: These are terms your competitor ranks for, but not very well. Maybe they’re on page 2, or their content is just plain bad. These are your top priority.

- Untapped Topic Clusters: You won’t just find one keyword. You’ll find a whole group of related keywords. This is a blueprint for an entire content cluster (a big “pillar” page and several “spoke” articles).

- Buyer-Intent Gaps: You might find your competitor is ranking for a bunch of “best X for Y” or “X vs Y” keywords. These terms signal a strong intent to buy. If you’re missing these, you’re missing sales. Period.

- Question-Based Keywords: You’ll uncover the literal questions your audience is typing into Google. These are perfect for new blog posts, H3s in existing articles, or nabbing a “People Also Ask” box.

- Feature/Product Gaps: Is your competitor ranking for terms about a specific product feature or service you don’t even offer? This is pure gold to take to your product development team.

Before You Start: What Do You Need?

Alright, hopefully, you’re sold on the “why.” Now let’s get into the “how.” Before you can run the analysis, you need to do a little prep. You can’t just dive in blind. You need two things: a crystal-clear list of competitors and the right tools for the job.

Don’t skip this step. Seriously.

The quality of your analysis is 100% dependent on the quality of your inputs. Garbage in, garbage out.

How do I find my real competitors?

This question trips more people up than you’d think. Your “real” competitors are not necessarily the brands you think they are.

Forget the big, obvious company names in your industry for a second. Your main business competitor (the one you bid against for clients) might not be your main search competitor.

A search competitor is any website, blog, or publication that ranks for the keywords you want to rank for.

I once worked with a B2B software company. Their sales team was obsessed with beating one other big software company. But when we looked at the search results, their real competitor was a niche industry blog run by a single person. This one blogger was eating their lunch on all the top-of-funnel, informational keywords.

So, how do you find them?

- Start with your “money” keywords. Take 5-10 of your most important keywords and Google them.

- See who shows up. Look at the domains that consistently appear on the first page.

- Use your SEO tool. Every major SEO tool (Ahrefs, Semrush, Moz) has a “Competitors” report. Plug in your domain, and it will spit out a list of domains that have the most keyword overlap with your site.

Start with this list. Pick 3-5 domains that are your aspirational peers or direct search competitors.

What’s the difference between a direct and an indirect competitor?

This is a critical distinction.

- Direct Competitors: These sites sell the same stuff you do. They target the same audience with the same type of product or service. If you’re Nike, this is Adidas.

- Indirect Competitors (or Content Competitors): These sites don’t sell what you sell, but they do compete for your audience’s attention. If you’re Nike, this might be Runner’s World magazine or a popular running blogger. They rank for all your “how to start running” or “best running shoes” keywords, even though they don’t actually sell shoes.

You need to analyze both.

Your direct competitors show you the commercial keywords you’re missing. Your indirect competitors show you the informational and top-of-funnel content gaps that are costing you audience trust and traffic.

Can I do this for free, or do I need to pay for tools?

Let’s be blunt. Doing this well almost always requires a paid tool.

The “big three” in this space are Semrush, Ahrefs, and Moz. Their keyword gap (or “content gap”) tools are the industry standard for a reason. They have massive keyword databases, great filtering, and make the process incredibly fast.

Can you do it for free? Sort of.

You could use Google’s free Keyword Planner. It has a feature called “Start With A Site” where you can plug in a competitor’s domain and see what keywords Google thinks that site is relevant for.

The problem? It’s clunky. It won’t give you difficulty scores, it’s not comprehensive, and you can’t easily compare multiple sites at once. You’re left trying to piece together a puzzle with half the pieces missing.

If you’re serious about growth, you need to invest in a proper tool. The good news is that most of them offer free trials. You can sign up, get a massive amount of data and actionable insights in a single weekend, and prove the tool’s ROI before you ever spend a dime.

My “Spreadsheet Nightmare”: Why the Right Tools Are a Game-Changer

I feel the need to double down on this point because I lived the “free” alternative. It was awful.

Early in my career, I was stubbornly cheap. I refused to pay for a “fancy SEO tool.” I thought I could do it all myself with free tools and spreadsheets.

My process was a manual nightmare.

I would use the free Google Keyword Planner to pull a list for Competitor A. I’d export it to a CSV. Then I’d do it for Competitor B. Export. Competitor C. Export. Then I’d pull my own keyword list from Google Search Console.

I’d dump all four massive spreadsheets into one giant Excel workbook.

Then, the “fun” began. I spent days—literal days—trying to wrangle VLOOKUP formulas and conditional formatting to find the keywords that were on their lists but not on mine. My eyes were burning. My formulas kept breaking. And at the end of a full week of work, I had a messy, overwhelming list that was already outdated and had no useful metrics like keyword difficulty or search intent.

I finally snapped. I paid for one month of Ahrefs.

I loaded up their “Content Gap” tool, plugged in my domain and my three competitors, and clicked “Show keywords.”

In less than 10 seconds… it was done.

The tool presented me with a clean, simple, filterable list of every keyword my competitors ranked for that I didn’t. I could filter by volume, difficulty, position, and more. The work that took me a week of manual, hair-pulling frustration was replicated—and done 100 times better—in the time it took me to grab a cup of coffee.

Don’t be me. Just use the tools.

What are the “big league” tools for this?

You have three main choices, and they’re all excellent.

- Semrush (Keyword Gap Tool): This is my personal favorite for this specific task. Its interface is just very intuitive. You can plug in up to five domains (including your own) and use simple buttons to see “Missing” keywords (they have, you don’t), “Weak” keywords (they rank higher than you), and “Untapped” (keywords any of them have that you don’t).

- Ahrefs (Content Gap Tool): Just as powerful. The logic is slightly different. You put in the competitor domains at the top, and your domain in the “But the target doesn’t rank for” box. It’s incredibly fast and its keyword database is legendary.

- Moz (Keyword Gap): Moz is also a fantastic competitor. Its gap analysis tool is straightforward and integrates perfectly with its other tools like Keyword Explorer and Link Explorer, giving you a very holistic view of the opportunities.

You honestly can’t go wrong with any of these. Pick the one whose interface you like best.

Are there any decent free or “lite” options to get started?

If you’re on an absolute shoestring budget, you have a couple of options, but just be prepared for more manual work.

- Google Keyword Planner: As I mentioned, you can use the “Start With A Site” feature. It’s better than nothing and can give you some high-level ideas.

- Ubersuggest: Neil Patel’s tool has a “Traffic Analyzer” section with a “Keywords” report that shows you what your competitors rank for. The free version is heavily limited, but it can give you a small taste of the data.

- Free Trials: This is your best bet. Sign up for a 7-day or 14-day trial of Semrush or Ahrefs. Dedicate one full day to nothing but running these reports, exporting all the data you can, and analyzing it. You can get a 6-month content plan from a single day’s work.

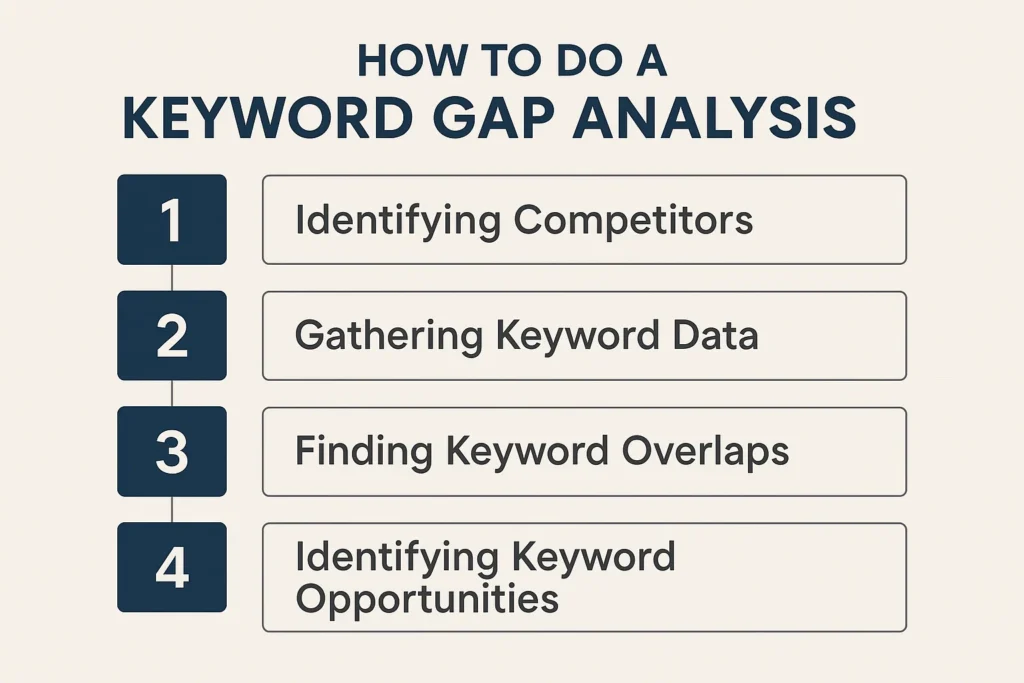

The Main Event: How to Do a Keyword Gap Analysis (Step-by-Step)

Okay, you’ve got your list of 3-5 competitors (a mix of direct and indirect). You’ve signed up for a trial of a powerful SEO tool. You’re ready to find that treasure.

Let’s walk through the exact process. The interface will look slightly different between Semrush and Ahrefs, but the logic is identical.

Step 1: How do I plug my competitors into the tool?

This is the easy part. Find the “Keyword Gap” or “Content Gap” tool in your platform.

You’ll see a series of boxes.

- Your Domain: Put your own website (

yourdomain.com) in the first box. This is your baseline. - Competitor Domains: In the following boxes, enter the domains of the competitors you identified. Most tools let you add 2-4.

That’s it. Hit the “Compare” or “Show Keywords” button.

You are about to be hit with a mountain of data. Do not panic. This is normal. The next step is where we turn this mountain into a molehill of pure gold.

Step 2: What do all these filters even mean?

The tool will now show you all the keywords that any of these domains rank for, with a bunch of columns and filters. This is where you filter out the noise.

You’ll see different “intersection” filters. In Semrush, they are plain-text buttons. In Ahrefs, it’s a visual diagram. The most important ones are:

- Missing (Semrush) / “Keywords [Competitors] rank for but [You] doesn’t” (Ahrefs): This is the goldmine. These are keywords your competitors rank for (somewhere in the top 100), but your site does not appear at all. This is your primary “gap” list.

- Weak (Semrush): This shows keywords where you and your competitors rank, but they rank higher than you. This is your “optimization” list—topics you’ve already covered but need to improve.

- Shared (Semrush): Keywords where all of you rank. This is useful for benchmarking but not for finding new opportunities. I usually ignore this at first.

For your first pass, select the “Missing” filter. This is the purest definition of a keyword gap.

Step 3: How do I find the real gold in this mountain of data?

You’ve clicked “Missing,” but you still might have thousands, or even tens of thousands, of keywords. Now we have to filter this list down to an actionable, prioritized list.

This is the most important part of the process.

You’ll see columns like Volume (monthly searches), KD% (Keyword Difficulty), Position (your competitor’s rank), and Intent.

Apply these filters, in this order:

- Filter by Position: Set the filter to show keywords where your competitors rank in the Top 10 (or Top 20, at most). Why? Because if they are ranking on page 1, you know Google finds their site relevant for that term. It’s a proven keyword.

- Filter by Keyword Difficulty (KD%): This is your new best friend. It’s a score from 0-100 that estimates how hard it is to rank for that term. Set a maximum KD of 30 or 40. This filters out all the hyper-competitive “head” terms and leaves you with keywords you can realistically rank for without a million backlinks.

- Filter by Volume: This is a bit counter-intuitive, but I often filter for a minimum volume of, say, 100 searches per month. This just cleans out the super-obscure, low-value terms.

After these three filters, your list of 10,000 keywords might now be a beautiful, manageable list of 50. This is your content plan.

Wait, what’s “Keyword Difficulty” and why does it matter most?

Volume is vanity, difficulty is sanity.

A keyword with 50,000 searches a month is useless to you if the front page is dominated by Harvard, Wikipedia, and The New York Times. You will never, ever rank for it.

Keyword Difficulty (KD) is a metric created by these SEO tools that analyzes the backlink profiles, domain authority, and content quality of the pages currently ranking. It tells you, “How big of a fight are you picking?”

By filtering for low-KD keywords, you’re specifically looking for fights you can win.

I would much rather find 10 keywords with a volume of 200 and a KD of 15 than one keyword with a volume of 50,000 and a KD of 90. I can actually rank for those 10 low-competition keywords. They will drive real, targeted traffic. The high-volume-a-thon is just a fantasy.

How do I filter for keywords I can actually rank for?

This is where you combine the filters. Your sweet spot, your “quick wins” list, is found by setting your filters to this:

- Competitor’s Position: Top 10

- Keyword Difficulty (KD%): 0-20 (or 0-30 if you have a more established site)

- Volume: 100+

The list that remains is your number one priority. These are topics that are proven to get traffic, are not yet hyper-competitive, and that your site is completely missing. Go get them.

I Found a Gap… Now What? (The Analysis Pitfall)

This is the part where I have to share another, less successful story.

Pumped up from my first “win,” I went back to the gap analysis tool. I ran it again, this time against a new competitor. I found what I thought was a monster keyword. It had a volume of 5,000 and a KD of only 22. My competitor was ranking #8 with a single, short forum post.

“I’ve struck gold!” I thought.

I spent an entire week on it. I’m talking a 4,000-word ultimate guide. I included custom graphics, expert quotes, and even a video. I hit publish, built a few internal links, and waited for the traffic to rain down.

And… crickets.

It never got above page 3.

I was baffled. I did everything right. The content was 10x better than the competitor’s. The KD was low. The volume was high. What went wrong?

I made the classic, rookie mistake: I never bothered to check the search intent.

I was so excited by the metrics that I never actually Googled the keyword myself. When I finally did, my heart sank.

The entire first page—all 10 results—was for e-commerce product category pages. People searching that term didn’t want a 4,000-word ultimate guide. They wanted to shop. They were looking for a page with a grid of products to buy. My informational blog post, no matter how “epic,” was the wrong type of content. Google knew this, and my article was buried.

How do I figure out what Google wants to show for this keyword?

This is the one step you cannot do inside your SEO tool. It’s a manual check, and it’s 100% non-negotiable.

Before you ever add a keyword from your gap analysis to your content plan, you must open an incognito browser window and Google it.

Look at the first page. Don’t just look at who is ranking. Look at what is ranking. What kind of pages are they?

- Are they blog posts/articles?

- Are they product pages?

- Are they category pages?

- Are they “listicle” style posts (“10 Best…”)?

- Are they videos?

- Is the entire page dominated by a “Featured Snippet”?

The results tell you exactly what Google believes the user’s intent is. Your job is not to reinvent the wheel. It’s to create the best version of what is already working. If the entire page is listicles, you must create a listicle. If it’s all product pages, you need a product page.

This is called “search intent matching.” It’s the step that turns a good analysis into a successful one.

Is this keyword informational, navigational, or transactional?

This is the more “textbook” way of thinking about search intent. As you analyze your gap keywords, try to categorize them:

- Informational: The user wants to learn something. (“how to tie a tie,” “what is keyword gap analysis”). These are perfect for blog posts and guides.

- Navigational: The user wants to go to a specific site. (“facebook login,” “ahrefs content gap”). You can usually ignore these.

- Transactional: The user wants to buy something. (“buy running shoes,” “semrush free trial”). These are for your product pages, service pages, or pricing pages.

- Commercial Investigation: The user wants to compare products before buying. (“semrush vs ahrefs,” “best running shoes for flat feet”). These are perfect for listicles, comparison posts, and reviews.

Make sure the content you plan to create matches the intent you’ve identified. That’s how my “wrong intent” mistake could have been avoided.

What if the gap is for a topic, not just one keyword?

This is the best-case scenario!

As you look at your filtered list, you’ll start to see patterns. You won’t just see one keyword. You’ll see:

- “how to do keyword gap analysis”

- “what is a keyword gap”

- “best keyword gap analysis tools”

- “content gap analysis”

This isn’t four blog post ideas. This is one topic cluster.

This tells you that you don’t just need one article. You need a central “pillar” page (like this one) that covers the main topic (“how to do a keyword gap analysis”) in depth. Then, you need smaller, supporting “cluster” articles (like “best tools”) that answer the specific sub-topics and link back to your main pillar.

This “topic cluster” model is exactly how you build topical authority in Google’s eyes. Your gap analysis just handed you the blueprint for it on a silver platter.

Prioritizing Your Attack: How to Build a Winning Content Plan

You’ve done it. You have a list of 50-100 “Missing” keywords. You’ve manually checked the search intent for each one. You’ve grouped them into topic clusters.

You feel amazing. And also… completely overwhelmed.

Where do you even start? You can’t write 50 articles tomorrow. This is the final, crucial step: prioritization. You need to turn this list into a 3-6 month content calendar.

Should I always go for the high-volume keywords first?

No. Absolutely not.

This is another common mistake. We’re drawn to big numbers. But a high-volume keyword is often more competitive (even if the KD score looks low) or has a very broad, “top-of-funnel” intent.

You want to prioritize based on a mix of three factors:

- Low Difficulty: How easy is it to rank?

- High Relevance / Intent: How valuable is this keyword to your business? Is it informational, or is it a “buy now” term?

- High Volume: How many people are searching for it?

Notice that “Volume” is last. I would always write an article for a low-volume, high-buying-intent keyword (“best B2B software for small law firms”) before I’d write one for a high-volume, low-intent keyword (“what is software”).

What is a “topical cluster” and how do I build one from my gap analysis?

We just touched on this, but let’s make it practical.

Look at your keyword list. Find 5-10 keywords that are all clearly about the same sub-topic (e.g., “running shoes for beginners,” “how to choose running shoes,” “best beginner running shoes”).

Plan to create this as a cluster.

- Pillar Page: Plan one “epic” guide (like “The Ultimate Guide to Running Shoes for Beginners”) that targets the main, broadest keyword.

- Cluster Posts: Plan 2-3 shorter, more specific posts that target the long-tail keywords (like “5 Best Beginner Running Shoes Under $100”).

- Link Them: When you publish, you will link from all the shorter posts up to the main pillar page. This tells Google that your pillar page is the most important, authoritative page on this topic.

Your gap analysis just gave you the outline for this entire, authority-building project.

How do I create a “quick wins” list?

This is your first priority. Your “quick wins” list is your low-hanging fruit. These are the articles you should write this month.

Go through your analyzed list and create a new, “top-priority” spreadsheet. A keyword gets on this list if it meets these criteria:

- It’s a “Missing” keyword. (You have 0 content on it).

- Keyword Difficulty is very low. (I’m talking 0-15).

- The search intent is clear. (You know exactly what kind of article to write).

- Your competitor’s ranking page is weak. (You Googled it and saw they’re ranking with a 500-word post, a forum, or an outdated article).

This is your attack plan. If you find 5-10 of these, that’s your content calendar for the next month or two. Go after these with everything you’ve got. They are the fastest way to prove the ROI of this entire process and get some immediate traffic wins.

Beyond Just Keywords: What Else Can This Analysis Tell Me?

The most obvious win from a gap analysis is a list of new blog post ideas. But if you stop there, you’re leaving 80% of the value on the table. This report is a deep-dive into your competitors’ entire online strategy.

You need to read between the lines.

Can this help me understand my competitor’s entire strategy?

Absolutely. Look at the patterns in the keywords they rank for that you don’t.

- Are they all informational “how-to” guides for beginners? Their strategy is top-of-funnel brand building.

- Are they all “X vs Y” comparison posts? Their strategy is capturing bottom-of-funnel, comparison-shopping traffic.

- Are they all keywords related to a specific product feature you don’t have? Their strategy is building a content moat around their unique selling proposition.

- Are they ranking for a ton of local keywords (“service near [City Name]”)? Their strategy is dominating local SEO.

This analysis shows you the shape of their marketing plan. It reveals their strengths, which you can choose to emulate, and their weaknesses (e.g., maybe they are ignoring all the beginner-friendly “how-to” content), which you can exploit.

What are “content gaps” and how are they different?

This is a subtle but important distinction.

A keyword gap is technical. It’s “they rank for this exact phrase, you don’t.”

A content gap (or topic gap) is strategic. It’s “they have an entire category of content that you are completely missing.”

Your analysis might not just show a single keyword like “best hiking boot.” It might show 50 different keywords related to hiking boots, hiking socks, waterproofing, and trail guides. The content gap isn’t just one keyword; it’s the entire topic of “hiking preparation.” Your competitor has built authority on this topic, and you haven’t even started.

Don’t just look for individual keywords. Look for the themes that emerge. That’s where the real strategic wins are.

Can I use this to find backlink opportunities?

This is an advanced, brilliant use of the same data.

Let’s say you’ve found a “quick win” keyword. Your competitor is ranking #5 with a really weak, 500-word article.

Now, take that specific article (the competitor’s URL) and plug it into your SEO tool’s “Site Explorer” or “Backlink Checker.” This will show you every single website that is linking to that weak article.

You now have a pre-built list of highly relevant websites to do outreach to.

Your pitch is simple: “Hey, I saw you were linking to that old article on [Topic]. I actually just published a much more comprehensive, up-to-date guide on the same subject. It covers [X, Y, and Z] that the other article missed. Thought it might be a valuable resource for your readers.”

This is called the “Skyscraper Technique,” defined by Brian Dean at Backlinko, and it’s infinitely more effective than cold email outreach. Your keyword gap analysis just gave you the blueprint for it.

Your Turn: Turning This Analysis Into Action

There’s a very real danger in this process. It’s the same danger that comes with any deep data dive.

It’s called “paralysis by analysis.”

You can spend weeks in these tools, filtering, exporting, and building “perfect” spreadsheets. You can admire your lists and all the “potential” they hold. And in all that time, you haven’t written a single word.

You haven’t helped a single customer. You haven’t captured a single new visitor.

What’s the biggest mistake people make after their first analysis?

The biggest mistake is inaction. They get buried in the data.

An 80% “good enough” list that you actually write content for is infinitely better than a 100% “perfect” list that sits in your Google Drive forever.

My advice: Time-box it.

Give yourself one day to do the analysis and build your “quick wins” list. That’s it. At the end of the day, lock the spreadsheet. For the rest of the month, your job isn’t to be an analyst; it’s to be a creator. Execute on the plan you just built.

How often should I be doing this?

This isn’t a “one and done” activity. The search landscape is always changing. Your competitors are always publishing new content. New competitors are always emerging.

I recommend doing a deep-dive gap analysis once every quarter. This is where you re-evaluate your main competitors, look for new ones, and build out your content plan for the next three months.

Then, I recommend doing a quick “check-in” once a month. You can run a “content gap” report just for keywords your competitors have started ranking for in the last 30 days. This keeps you on the pulse of their very latest content efforts and ensures you never get left behind.

This whole process, from identifying competitors to filtering for low-KD gems, is the very definition of “working smarter, not harder.”

You have a finite amount of time and energy. You can’t afford to waste it writing content that nobody is looking for. Your competitors are literally showing you a list of topics that are proven to work. They’re telling you which keywords they’re winning and, more importantly, where their content is weak.

A keyword gap analysis takes all the guesswork out of your content strategy. It’s the map that leads you directly to the treasure.

So stop guessing. It’s time to go find it.

FAQ

What is a keyword gap analysis and why is it important?

A keyword gap analysis is the process of identifying valuable keywords that your competitors rank for, but you do not, allowing you to develop a data-driven content strategy to target proven audience interests and improve your search rankings.

How do I identify my real competitors for a keyword gap analysis?

Your real competitors are not necessarily the brands you think they are; they are websites that rank for your target keywords. You can find them by searching your main keywords on Google, noting who appears on the first page, and using SEO tools to analyze keyword overlap.

Do I need paid tools for a keyword gap analysis?

While free tools like Google’s Keyword Planner and Ubersuggest can provide some insights, conducting a comprehensive and efficient keyword gap analysis almost always requires paid SEO tools like Semrush, Ahrefs, or Moz, which have extensive databases and better filtering capabilities.

What are the key steps to perform a keyword gap analysis effectively?

The key steps include inputting your domain and competitors into an SEO tool’s gap analysis feature, filtering the results for ‘missing’ keywords where your competitors rank but you do not, then prioritizing these keywords based on criteria like search volume, difficulty, and intent to create an actionable content plan.

How can I ensure the search intent matches my content strategy after finding a keyword gap?

To verify search intent, manually Google the target keyword in an incognito window and analyze the type of content ranking on the first page, then create content that aligns with this format—be it an informational article, product page, or listicle—to meet what users are actually seeking.